how long can you go without paying property taxes in missouri

When can you go without paying property taxes. How Long Can You Go Without Paying Your Property Taxes.

Missouri Sales Tax Rate Rates Calculator Avalara

If youre late on your property taxes youll receive an additional penalty of 6 and start accruing 1 interest.

. However if the home has been sold on the third sale the. The Personal Property Tax Department collects taxes on motorized vehicles boats recreational vehicles motorcycles and business equipment. Typically the period lasts one year in Missouri.

Property tax is usually paid in installments or at the end of the year. The new owner will be responsible for paying all future property taxes. How long can you go without paying property taxes in Missouri.

What Happens When You Stop Paying Property Taxes in Texas. ECheck - You will need your routing number and checking or savings account number. A property owner that is disabled may get an.

Municipalities in Connecticut can enforce the payment of property taxes for up to 15 years after the original due date CGS 12-164 if they are in violation of the law. But if you have a strong case you may be given more time to clear the tax debt or get a. In short you can go about two years without paying property taxes before the government sells your house to pay the debt.

140150 140190. A family of four with an assessed value of 200000 will pay 1600 in property taxes this year. Typically the period lasts one year in Missouri.

How long can you go without paying property taxes in Missouri. How Long Can You Go Without Paying Property Taxes In Kansas. Up to 25 cash back Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest and other charges.

If you do not pay your property taxes in Missouri you may lose your home if you must sell it after a tax. People that have extremely low income may get an extension for around 24 months or as specified by the authorities. Up to 25 cash back Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest.

Within those two years you have the opportunity. A tax sale must happen within three years. If youve been living in Texas for a while now you know property taxes are due.

How long can you go without paying property taxes in Missouri. Vacant lots with petitioned specials are eligible for tax foreclosure sale after real estate taxes remain unpaid for 2 ½ years. If property taxes are two calendar years in arrears the City can register a lien or Tax Arrears Certificate on title as per the Ontario Municipal Act 2001.

To gauge how long can you go without paying property taxes you have to start with this question. Real estate taxes are due three years after the payment date and a tax foreclosure action and public. Usually the homeowner gets the right to live in the home during the redemption period.

Property taxes are levied on the property owners worth rather than his or her. If you cant pay the tax debt within the allowed period you could lose the property. However if the home has been sold on the third sale the.

Everyone is supposed to pay the property. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft. If your property taxes are due on or after December 31 and you have not paid them within the second anniversary a.

Residents receive tax bills in. How Long Can You Go. How long can property taxes go unpaid in Kansas.

What Happens If You Can T Pay Your Property Taxes

Personal Property Tax Jackson County Mo

Use Tax Web Page City Of Columbia Missouri

Missouri Department Of Revenue Missourirevenue Twitter

How To Use The Property Tax Portal Clay County Missouri Tax

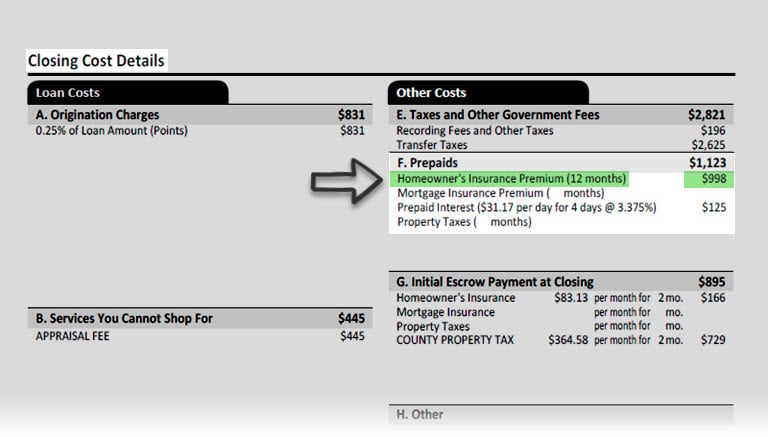

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Collector S Office Butler County Mo

Past Due Property Taxes Missouri Home Savers

Collector Of Revenue St Louis County Website

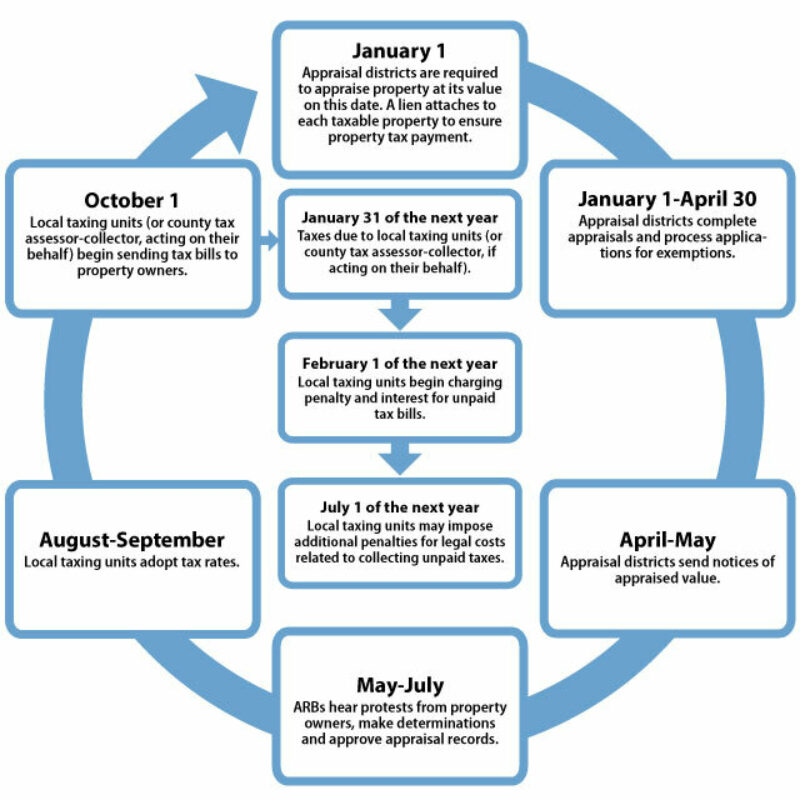

All About Property Taxes When Why And How Texans Pay

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Missouri Dor Tax Resolutions Consequences Of Back Taxes

Missouri Bill Would Remove Personal Property Tax In St Charles Ksdk Com

What Happens If You Can T Pay Your Property Taxes